Times are tough, and your current finances may be even tougher. The worldwide COVID-19 pandemic brought mayhem to the world of business – many of which have either had to close their doors, move to home offices, or had to re-think their entire business strategy.

Face the facts; As a business, this is just not the time to be spending money – it’s the time to be cutting your expenses in half.

We’ve come up with our very best strategies to reduce your business costs. Ensure you and your business are saving pennies in all the right places, whilst still maximising your potential to generate the most income that you can. Read our 10+ techniques below…

10+ Ways to Reduce Business Costs:

The difficulties that we’re all facing are a marathon, not a sprint – and it’s important to remember that cutting costs today will save you in the future. Check out our top tips to reduce business costs now:

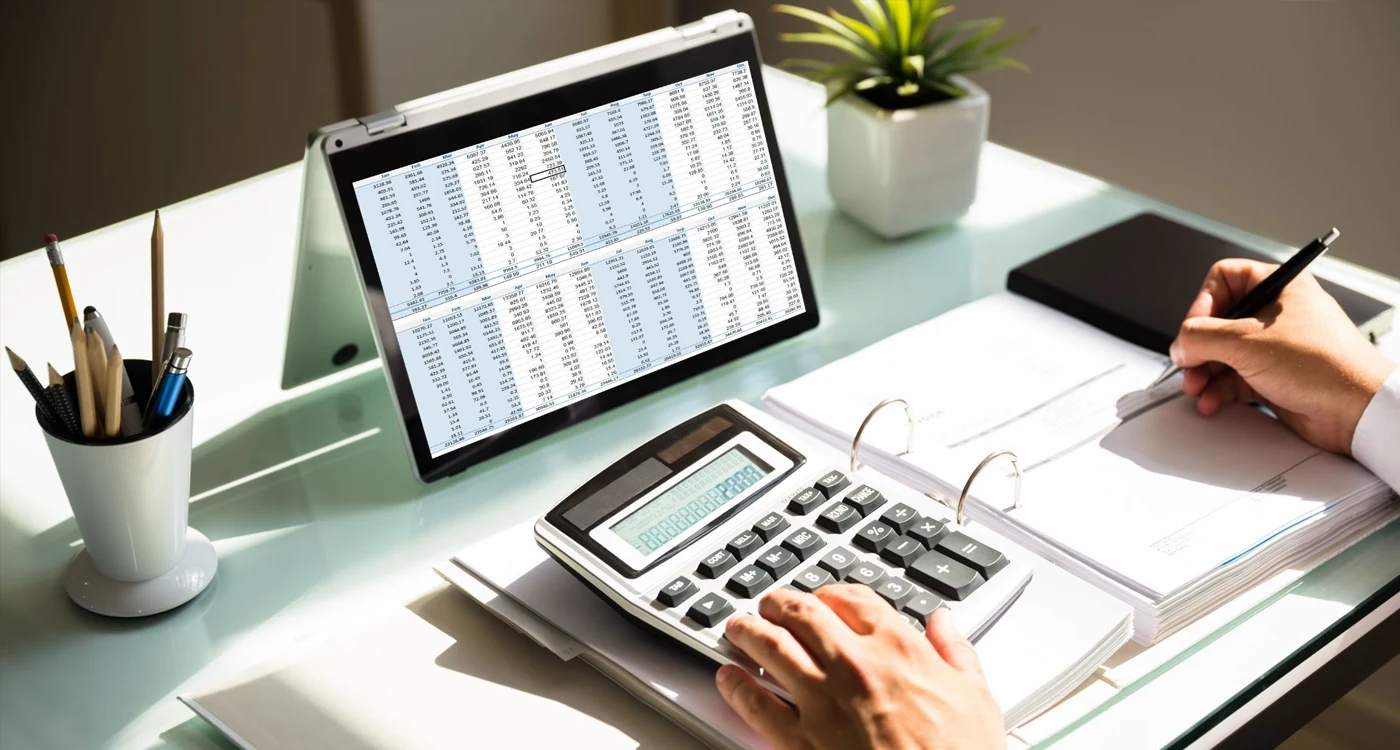

1. Review expenses & identify areas to cut back on

This could include everything from your office supplies to your marketing budget. For example, you could:

- Track your spending for a month to see where your money is going.

- Compare your spending to industry benchmarks to see if you are overspending in any areas.

- Negotiate better rates with your suppliers.

- Look for ways to reduce your energy consumption, such as by turning off lights and electronics when you’re not using them or by investing in more energy-efficient equipment.

Another often overlooked expense includes your office and company premises…

2. Downsize your office space or relocate

If you have more space than you need, consider downsizing to a smaller office or subletting some of your space. This can save you a significant amount of money on rent and utilities.

By moving to a cheaper location, you can quickly reduce one of your potentially biggest business costs. If this isn’t possible, sharing the premises with other businesses under a co-letting arrangement is a great alternative.

With more and more roles going remote, exploring a Work From Home arrangement with your employees could prove beneficial.

3. Try to negotiate better deals with your suppliers

Don’t be afraid to shop around and compare prices before you commit to a vendor if possible. If you haven’t already, try to negotiate lower prices by:

- Asking for discounts for bulk orders or long-term contracts.

- Offering to pay upfront for a discount.

- Reminding the vendor that you are a loyal customer.

- Adapting your product selection.

If you’re a business that relies on suppliers, whether that means mobile phones like us, various services that are utterly essential to your business, products or stock for retail, or even IT systems – it’s a really good idea to just pick up the phone and speak directly to them.

Chances are that your suppliers will be more concerned with keeping your business and any long-standing arrangements. So they’ll be more than willing to hear out your individual situations and will be ready to negotiate. Now is not the time to be losing clients – even if that means minimising or delaying payments for the time being.

4. Reduce your energy consumption

Electricity is one of many overheads of business, though there are still steps you can take to reduce these costs. This could involve making simple changes like turning off lights and electronics when you’re not using them or investing in more energy-efficient equipment. You can also:

- Seal air leaks and drafts around doors and windows.

- Upgrade to more efficient LED lighting.

- Install a programmable thermostat.

- Encourage employees to turn off lights and electronics when they leave for the day.

5. Outsource non-core functions

Sometimes, it’s much cheaper to delegate certain tasks to an external agency, rather than keeping it all in-house. This could include things like accounting, payroll, or customer service.

Outsourcing these functions can save you money on labour costs and benefits, and it can also free up your employees to focus on more important tasks.

6. Automate Tasks

Nowadays, more tasks than ever can be automated. With the rise of popular AI tools and other integrations, tasks like data entry, social media marketing, and even accounting can be automated. This can free up your employees to focus on more important matters, or even remove the need for them entirely. Why hire a copywriter when AI will do it for you?

7. Reduce Costs with Cash Resources

This may be a long shot, but now would be a great time for your business to chase up any outstanding payments that you’re owed. You may have cash reserves to keep you afloat for a while – but that won’t last forever, so it’s important to gather up payments while you can.

Whether that be for services you’ve provided or items that you’ve sold and not yet received payment for – chase up those invoices!

You may also want to look into any resources that the government is currently offering to businesses. There are a whole range of support options that are currently being offered to UK businesses such as business rates relief, support grant funds, and help with paying employees.

We strongly believe that with a combination of readily available cash and government-offered support, your business will come out strong.

8. Government Grants, Schemes, and Tax Breaks

The UK government offers a variety of grants and schemes designed to help your business reduce costs and improve its bottom line. These programs vary depending on the size, location, and industry of the business, but here are some general categories and examples:

Energy Efficiency:

- Industrial Energy Transformation Fund: Grants for industrial businesses to reduce energy consumption and emissions.

- Energy Bill Relief Scheme: Financial support for businesses facing high energy bills.

- Green Grants: Schemes to help businesses improve energy efficiency with insulation, lighting upgrades, and renewable energy technologies.

Tax Relief:

- Annual Investment Allowance: Allows businesses to write off the cost of qualifying plant and machinery against their taxable profits.

- Super-deduction: Provides additional tax relief for investments in new qualifying plant and machinery.

- Research and Development (R&D) Tax Credits: Reduces taxable profits for businesses investing in R&D activities.

Specific Industries:

- Maritime Freight Grants: Support for businesses using more environmentally friendly maritime freight transport.

- Woodland Creation Planning Grant: Assists businesses with planning for woodland creation on their land.

- Start-Up Loans: Government-backed loans with lower interest rates available to new businesses.

Regional Support:

- Levelling Up Funds: Grants for infrastructure projects, business growth, and community development in specific regions.

- City Deals: Tailored packages of investment and support for specific cities in England.

Still unsure if your business qualifies for government support? Search for UK government grants by location/industry here.

Or explore various UK government business support schemes at https://www.gov.uk/business-finance-support.

9. Consider Staffing

As a last resort, you may want to consider reducing either your staff or their hours. It’s important not to rush into cutting down staff, bearing in mind the fact that when this pandemic is over – you’ll need to be ready to resume business as usual, but it’s still a good idea to consider the following options:

- Reducing hours: This isn’t ideal and definitely won’t get you a vote for boss of the year, but slightly reducing your employee’s hours is a far better option than leaving them unemployed.

If you were to even reduce all of your employees hours by just one a day (without causing any damage to profit) – you could save a relatively large amount of money when you need it most. - The Government Furlough Scheme: If you feel it necessary, you may consider furloughing some of your employees. Learn more about the Furlough scheme here.

- Individual Staff Offers: Take the time to discuss with each member of your team what’s possible for them and plan from there.

- Redundancies: This shouldn’t be necessary, but if you feel you’re left with no choice – this may be a last-resort option when you consider the business’s long-term survival requirements.

Want to ensure maximum efficiency among your team? Read through our list of the best work apps for management and connectivity!

10. Go Back to Basics

Before renewing any services, applications, or contractors, consider any that aren’t absolutely essential to your business right now. These may be valuable to you, but if you don’t truly need them right now – they can wait. You don’t need frills, you don’t need to be spending money on trying out new things, you need functionality. That means, if you’re in the middle of implementing a fancy new referral service or paying £££ for someone to revamp your website – it’s time to stop and reconsider.

Take the time to build up a picture of your costs and evaluate what currently serves a real purpose. If your business was working just fine beforehand, chances are that they’re just unnecessary costs, at least for the time being.

11. Get Creative!

There are always new ways to save money. Be creative and think outside the box to find solutions that work for your business. For example, you could:

- Offer a referral program to encourage customers to refer new business to you.

- Hold a contest or giveaway to generate interest in your products or services.

- Partner with another business to offer a joint promotion.

How to Set Your Business Budget

Budgeting is the cornerstone of any successful business and will definitely help you to reduce your costs. It provides a roadmap for your financial journey, ensuring you allocate resources effectively and achieve your financial goals.

Here’s our comprehensive guide to creating a solid budget for your business:

1. Lay the Foundation

- Gather financial data: Collect past income statements, balance sheets, and expense reports. If you’re a new business, estimate future income based on industry benchmarks and marketing research.

- Identify your budget cycle: Will you budget monthly, quarterly, or annually? Align your cycle with your financial reporting and decision-making needs.

- Choose a budgeting method: Popular methods include zero-based budgeting, incremental budgeting, and activity-based budgeting. Research and select the method that best suits your business model and information availability.

2. Estimate Income

- Analyze historical sales data: Identify trends, seasonality, and any external factors influencing revenue.

- Forecast future sales: Consider marketing initiatives, upcoming product launches, and economic projections. Be realistic and factor in a margin of error.

- Include all income streams: Include not just core sales but also secondary sources like rental income, interest income, and government grants.

3. Categorise Expenses

- Fixed costs: Rent, salaries, insurance, utilities, etc., remain constant regardless of activity.

- Variable costs: These fluctuate with production or sales volume, like materials, commissions, and shipping costs.

- One-time expenses: Include capital expenditures, marketing campaigns, or research & development investments.

- Contingency fund: Allocate a buffer for unexpected expenses or emergencies.

4. Allocate Resources

- Prioritize essential costs: Ensure core business operations are funded adequately.

- Balance growth and profitability: Invest in strategic initiatives while maintaining financial stability.

- Use data-driven decisions: Allocate resources based on past performance, future projections, and return on investment (ROI).

5. Monitor & Adapt

- Track actual income and expenses: Regularly compare them to your budget.

- Identify variances: Investigate significant deviations and adjust your budget accordingly.

- Be flexible: Adapt your budget to changing market conditions or business needs.

- Review and revise: Regularly review your budget and update it as necessary.

Additional Tips:

- Use budgeting software: Automate calculations and gain valuable insights from reports.

- Involve key stakeholders: Get buy-in from department heads and financial teams.

- Communicate transparently: Share the budget with employees to foster accountability.

- Seek professional help: Consult an accountant or financial advisor for complex situations.

Remember, budgeting is an ongoing process. By following these steps and continuously refining your approach, you can create a financial roadmap that drives sustainable growth and success for your business.

Take Action!

While you may be hoping for the best, it’s absolutely essential that you’re preparing for the worst. It’s entirely possible that even if you’re not desperate or struggling with money today – the truth is that we just don’t know how long this is going to go on for, or what the outcome for business will be like when everything returns to ‘normal’ – so make sure your choices remain sensible.

What does that mean? You don’t want to be maxing out your personal credit cards to cover bills, you don’t want to be missing payroll cycles because you think you can cover them at a later date. Those are all choices that you may not be able to crawl back from.

This could also mean upgrading your current outdated systems to more efficient, modern solutions. For example, our business mobile deals are highly economical and a great way to cut costs + optimise communications. Alternatively, see our VoIP phone systems for business now.

It’s so important to stretch out your money and cut out all non-essential costs, whilst making clear decisions on what’s really important for your business in the long term and avoiding any potential debt.

Missed one too many payments? Learn how to get a business phone contract with bad credit here.

Keep Calm (and carry on!)

It’s so important that you don’t panic when it comes to managing your finances – both for the current period of mayhem and in the long term. While it’s important to reduce business costs now, you need to focus on what’s going to help you in the long run, not just focus on short-term survival.

All the decisions you’re having to make right now will require you to be a strong leader – and it’s so important to remain empathetic, courageous, and take any and all data into account with your decisions.

As businesses, now is the time to stick together. With the correct cost-cutting measures, contingency plans, and business strategy, along with continued support across the industries – we can all get through this together.

Make sure you find the perfect plan for your business. Find & compare the best business phone plans and the benefits behind them. After that, check out our list of the Top 10 Best Mobile Phone models for Business!